how to pay indiana state estimated taxes online

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. If the amount on line I also includes estimated county tax enter the portion on.

How To Calculate Safe Harbor Estimated Tax Payments

If you have not yet filed your tax return when you reach the File section you have the option to either have the.

. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If the amount on line I also includes estimated county tax enter the portion on. Estimated payments may also be made online through Indianas INTIME website.

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you. Indianas statewide income tax has.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. How do i pay state taxes electronically for Indiana on epay system. How To Pay Estimated Taxes.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. 081 average effective rate. Department of Administration - Procurement Division.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. June 5 2019 250 PM. Completing Form ES-40 and.

32 cents per gallon of regular gasoline and 53 cents per gallon of diesel. Depending on the amount of tax you owe you. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

We last updated the Estimated. SBAgovs Business Licenses and Permits Search Tool. How To Pay Your Taxes With A Credit Card In 2022.

When you filed your state return TT would have told you the various options as follows. To make an individual estimated tax payment electronically without logging in to INTIME. Select the Make a Payment link under the.

Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes. Know when I will receive my tax refund. Access INTIME at intimedoringov.

Indiana Small Business Development Center. Find Indiana tax forms. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

How To File And Pay Sales Tax In Indiana Taxvalet

Aci Payments Inc Pay State Estimated Quarterly Taxes

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Indiana Income Tax Calculator Smartasset

Where To Mail Your Estimated Tax 1040 Es Form Don T Mess With Taxes

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

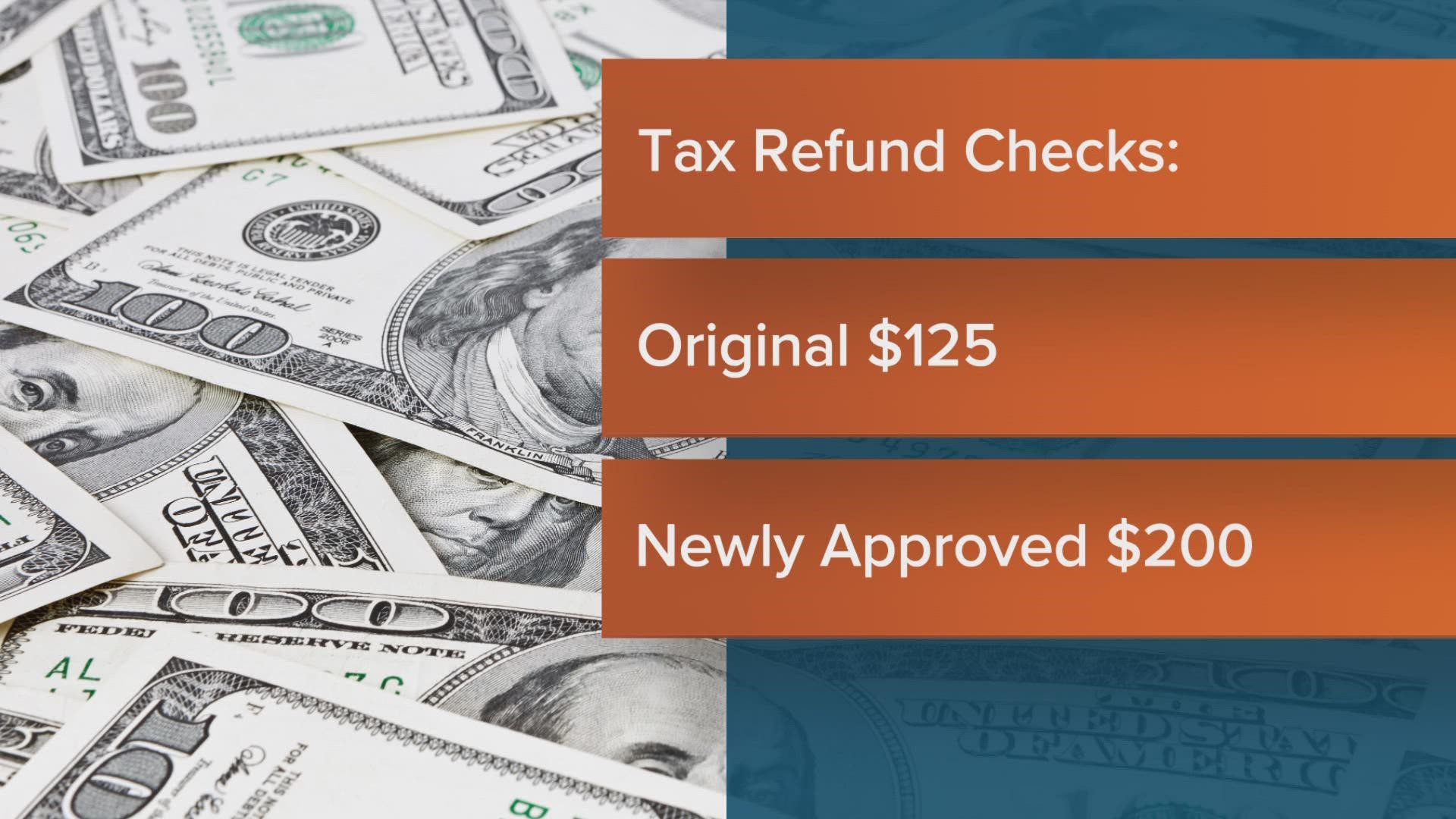

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Tax Season 2021 Quarterly Taxes Still Due April 15 For Most

Estimated Quarterly Tax Payments Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

The Complete J1 Student Guide To Tax In The Us

Dor Completing An Indiana Tax Return

Latest Impacts To 2021 Tax Season Filing Dates Wolters Kluwer

Fill Free Fillable Forms State Of Indiana

Indiana Tax Refund Here S When You Can Expect To Receive Yours

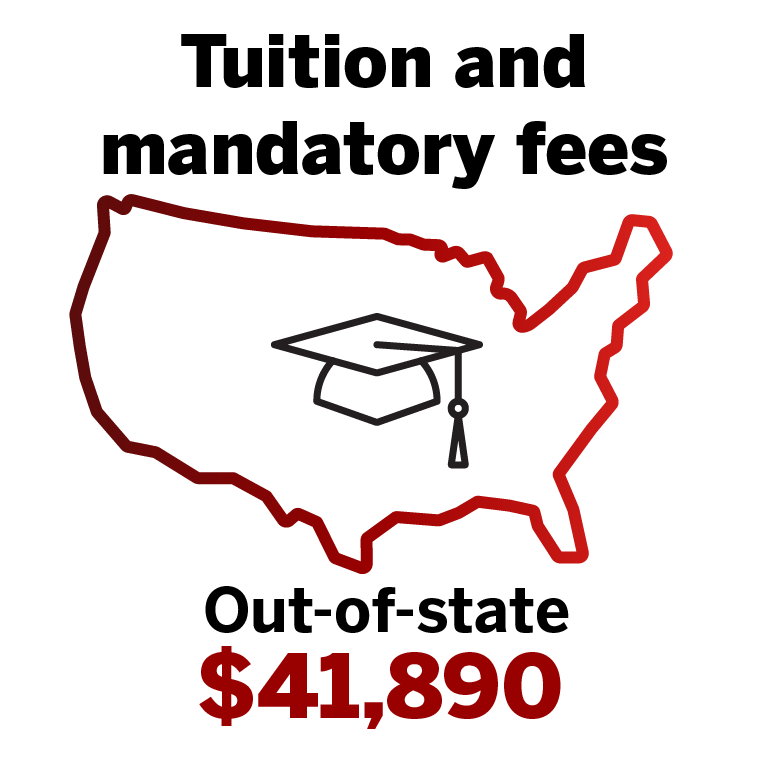

Estimated Cost Of Attendance Cost Of Iu Paying For College Student Central Indiana University Bloomington

Here S When You Can Expect Your Indiana Tax Refund Check Wthr Com

Quarterly Estimated Tax Payments Who Needs To Pay When And Why